Funding and Budget

Funding

By state law, emergency service districts can be funded in two ways:

- Property taxes, not to exceed $0.10 per $100 valuation; and

- Sales and use taxes of up to 2% for a maximum total rate of 8.25%.

Currently, ESD 8 is funded

only by property taxes at a rate of $0.094. For an average $500,000 home, this is roughly $40 per month or $470 per year. ESD 8 can also adopt a 2% sales and use tax if authorized by voters.

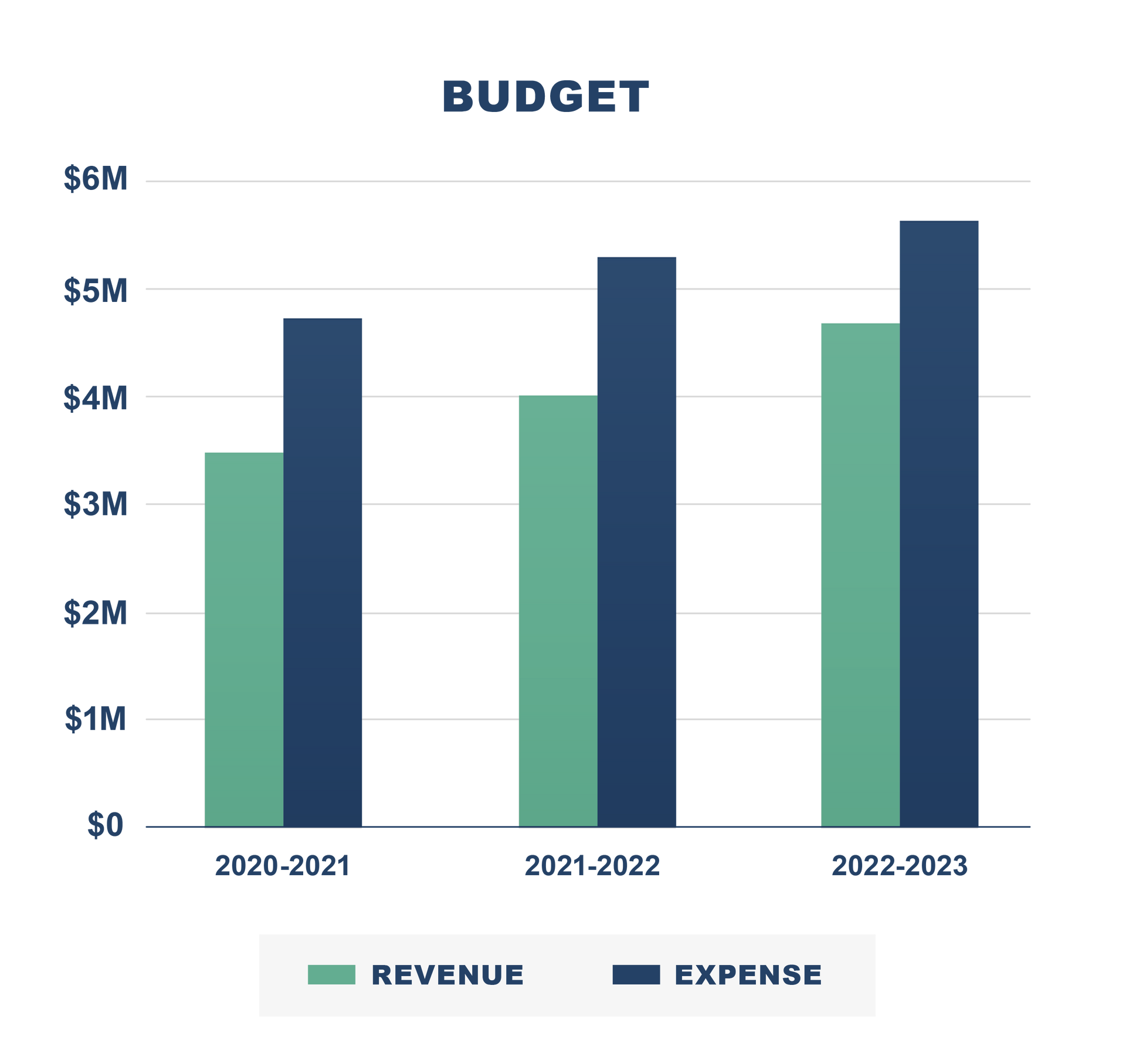

Budget

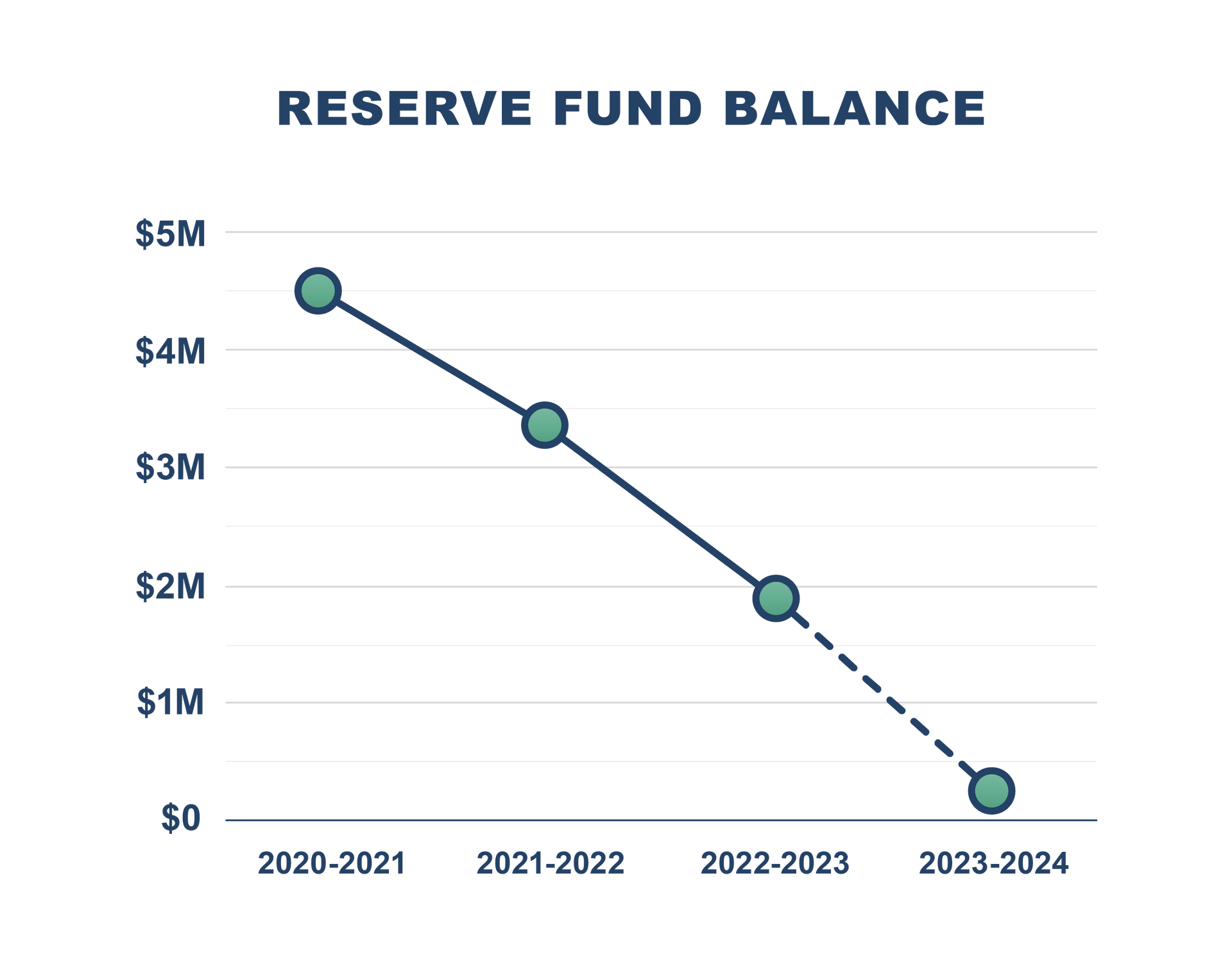

The ESD 8 Commissioners have done their best to set aside funds knowing that with more growth, more fire stations would be needed, and operational costs would be increasing. However, our reserve fund is depleted and property tax income is not covering ESD 8 costs, even considering recent growth. From 2020 to 2023, ESD 8 has been operating at a net loss averaging $1.1M per year. Based on projections from early 2023, it is anticipated that by the year 2024, ESD 8 will not be able to fund existing operations nor contribute to the three new fire stations planned in the area.

In order to properly fund ESD 8, the Commissioners will consider asking voters to adopt a 2% sales and use tax. Adoption of a sales and use tax would help diversify funding so that it is not paid solely by property owners. All of the ESDs surrounding the Georgetown area have seen the importance of a diversified tax base and allocate up to 2% of the sales and use tax for emergency services—including the ESDs serving Hutto, Liberty Hill, Florence and Round Rock.