November 5, 2024 Election Information

On November 5, 2024, voters in Emergency Services District No. 8 approved Proposition A: the adoption of up to a 2% sales and use tax to fund local emergency services, bringing the total tax rate to 8.25%. This tax will apply to all goods purchased in ESD 8 and at online retailers.

The new sales tax revenue will help ESD 8 maintain and enhance emergency services through its partnership with Georgetown Fire Department, supporting the construction of new fire stations and the purchase of life-saving emergency equipment. Thank you to ESD 8 voters for your support!

Background

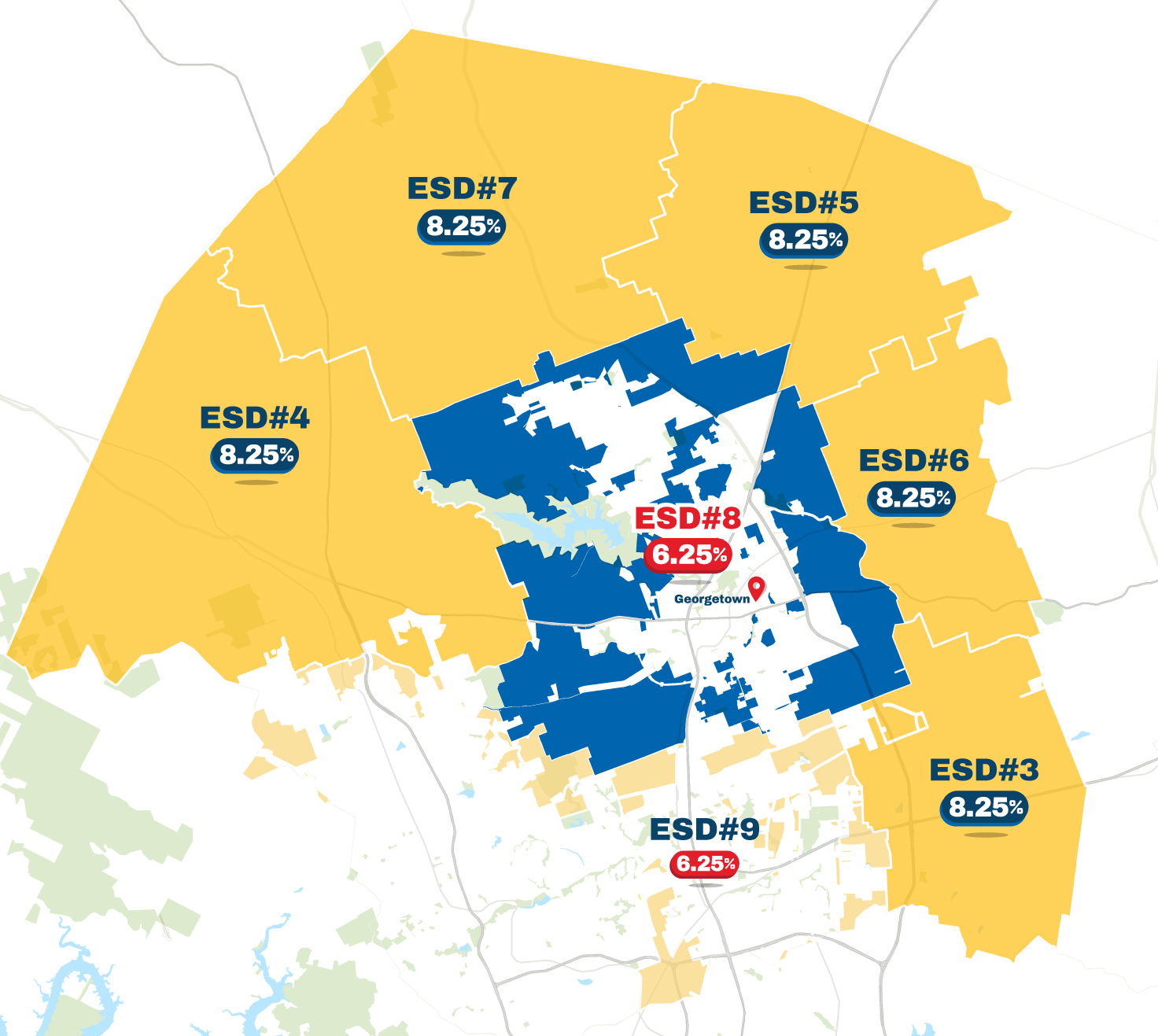

In Texas, the state sales tax rate is 6.25%. Local taxing entities can impose a 2% sales tax for a combined total rate of 8.25%. If approved by voters, ESD 8 will be able to collect 2% of sales taxes to fund emergency services, similar to neighboring districts like Jarrell, Hutto, Liberty Hill and Florence.

ESD 8 is currently funded only by property taxes. As the region’s population has grown, so has the demand for emergency services, with a 250% increase in emergency calls in the last decade. Coupled with inflation and the rising cost of equipment like fire engines, property taxes alone are not adequately funding emergency services.

Without additional funding, response times across the ESD are likely to increase.

Voting Dates and Locations

Key Dates

Monday, Oct. 7 - Last Day to Register to Vote

Friday, Oct. 25 - Last Day to Request Ballot by Mail

Early Voting

Monday, Oct. 21 – Saturday, Oct. 26 (8:00 a.m. - 6:00 p.m.)

Sunday, Oct. 27 (Noon - 6:00 p.m.)

Monday, Oct. 28 – Friday, Nov. 1 (7:00 am – 7:00 pm)

Election Day

Tuesday, Nov. 5 (7:00 am - 7:00 pm)